Solar Energy Corporation of India Limited (SECI) is the foremost Navratna CPSU dedicated to the growth and development of Renewable Energy (RE) capacity in India.

To realize India’s ambitious RE targets, the Government of India designated SECI as a nodal agency to enable meeting the growing energy demand through RE and reducing the dependence on fossil fuels. Looking at the huge success of SECI’s performance over the years, the Government has appointed other agencies also, designating these as Renewable Energy Implementing Agencies (REIAs), for working towards the common goal of RE expansion.

SECI has been spearheading innovation in the RE sector since its inception through various innovative project configurations. Models like solar-wind hybrid with/without energy storage, Round-the-Clock (RTC) power supply, RE with assured peak power supply, Firm and Dispatchable RE (FDRE), etc., have greatly promoted the growth of the RE market and created a thriving ecosystem for RE, whilst optimizing RE uptake among various states as per the sector’s evolving landscape.

The organization’s unique business model of transparent e-bidding is one of the major reasons for a substantial reduction of renewable energy tariffs in the country that has resulted in an increase in green energy access. This model has brought investments both from domestic and foreign countries into the sector while improving bankability of projects and ensuring payment security.

The company primarily operates under the following domains:

I. Energy Management (Power Trading)

SECI is a Category-I (highest) Power Trading Licensee for trading power on Pan-India basis. It is the intermediary power procurer for projects being set up through SECI tenders. It procures power from successful developers under its tenders and sells to Buying Entities (i.e. DISCOMs) though long term PPAs and PSAs respectively. SECI is a premier trader of RE power in the country.

SECI serves as an implementing agency for the development of Solar, Wind and Hybrid Projects as part of fulfilling the country’s Nationally Determined Contributions (NDCs). To achieve this, SECI releases tenders for selection of Renewable Energy (RE) developers for establishment of Projects on a Pan-India or State-specific basis. The selection process for successful bidders is conducted through a tariff-based competitive e-bidding procedure. Once selected, SECI enters into a 25-year Power Purchase Agreement (PPA) with the chosen bidders for the procurement of power from these projects. Further, SECI establishes back-to-back 25-year Power Sale Agreements (PSA) with DISCOMs/buying entities for sale of the procured power.

SECI monitors the progress of the projects during implementation stage. During implementation and post-commissioning of these projects, all legal and commercial issues are handled for 25 years. After the completion of PPA period, decommissioning of the projects are also monitored as per contractual provisions.

II. Setting Up Projects Through Own Investment

a. Projects under Construction

|

S. No. |

Type |

Location |

Capacity (MW) |

Status (as on 01.05.2025) |

|

1 |

Floating solar |

Getalsud, Jharkhand |

100 |

Under Construction |

|

2 |

Solar + BESS |

Leh, UT of Ladakh |

25 |

Under PMDP Scheme; Under Construction |

|

3 |

Solar (DCR) |

Ramagiri, Andhra Pradesh |

300 |

Under CPSU scheme Phase II-(T-III)

Under Construction

|

b. Projects in Pipeline

|

S. No. |

Type |

Location |

Capacity (MW) |

Status (as on 01.05.2025) |

|

4 |

Solar (DCR) |

Radhanesda, Gujarat |

700 |

Pre-tendering activities on going.

|

|

5 |

Solar (DCR) |

Dhar, Madhya Pradesh |

200 |

Tender issued

|

|

6 |

ESS |

To be identified |

1200 MWh |

Vide MoP OM dated 17.04.2025, SECI has been allotted VGF for undertaking projects for market based operation.

|

III. Consultancy Services

SECI offers Project Management Consultancy in Renewable Energy sector to Public Sector/Government entities, including Feasibility Studies, Bid process Management, Construction Monitoring and Management, Commissioning etc. It has been catering to domestic clients and is now looking to expand its scope to international clients as well. Due to global commitments, the country is moving toward faster adoption of Renewable Energy, as a result of which an increased number of PSUs/government agencies are foraying into this sector. SECI provides its expertise to such clients in bringing up RE projects and aims at executing a larger share of consultancy projects in the coming years. Over 350 MW of projects have been commissioned under this model.

|

Type |

Govt. Agency & Location |

Capacity (in MW) |

|

Major Completed Projects |

||

|

Solar |

Singareni Collieries Company Limited (SCCL), Telangana |

224 |

|

Solar |

IREDA, Kerala |

50 |

|

Solar |

THDC, Kerala |

50 |

|

Solar |

Bharat Electronics Limited, Telangana |

16 |

|

Solar |

Bharat Dynamics Limited Telangana |

10 |

|

Major ongoing/planned Projects |

||

|

Floating Solar |

DVC, Jharkhand & West Bengal |

30 (6 MW commissioned) |

|

Floating Solar |

BBMB, Himachal Pradesh |

15 |

|

Solar |

Power Development Department, Ladakh |

12 |

|

Status: As on 01.05.2025 |

||

IV. Emerging Areas

To align with the rapidly evolving RE sector, SECI is venturing into new business areas, including Green Hydrogen, Greening the Transport Sector, Energy Storage, Market-Based Models for Supply of RE, among others.

In doing so, SECI is actively collaborating with relevant stakeholders to explore and tap into the potential of these emerging opportunities.

a. Green Hydrogen: As the global consensus towards Net Zero gathers momentum, the demand for Green Hydrogen and its derivatives is set to rise. The asymmetries in expected demand and production capabilities for Green Hydrogen, in different countries and regions, are likely to result in international trade of Green Hydrogen and its derivatives like Green Ammonia and Green Methanol. The Ministry of New and Renewable Energy is implementing the National Green Hydrogen Mission (NGHM) which aims to make India the Global Hub for production, usage and export of Green Hydrogen and its derivatives. SECI has awarded 412,000 metric tons of green hydrogen production capacity and 1.5 GW electrolyser manufacturing capacity under the Strategic Interventions for Green Hydrogen Transition (SIGHT) scheme.

b. Offshore Wind: Ministry of New and Renewable Energy has issued a ‘Strategy for Establishments of Offshore Wind Energy Projects’ indicating a bidding trajectory of 37 GW by 2030 and various business models for project development. SECI has issued the first tender for ‘Leasing out Seabed for development of 4 GW of Offshore Wind Power Projects’ under Captive Mode/bilateral agreements/Open Access Mode in line with Offshore Wind Strategy.

c. Supply of Green Power in Transport Sector: The transport sector offers huge potential for transition to Clean Energy sources, especially through Electric Vehicles. SECI has entered into MOU with NCRTC & BPCL for Greening of the Transportation sector.

d. Energy Storage: The integration of energy storage systems into the Indian Power sector is essential to enhance the utilization of renewable energy infrastructure. With this aim SECI has issued various tenders with provisions for setting up of energy storage systems both on standalone and integrated basis.

e. Development of Market-Based Models for Supply of RE: SECI is exploring development of market-based models for supply of RE power that is under deliberation by concerned stakeholders.

f. PLI Scheme For High Efficiency Solar Cells & Modules: The scheme introduced by the Government aims to build an ecosystem for manufacturing of high efficiency solar cells and modules thus reduce import dependence. SECI is the implementing agency for the Tranche-II of the Production Linked Incentive Scheme for High Efficiency Solar PV Modules. Under the scheme, SECI has issued Letter of Award to 11 successful manufacturers in April 2023 to set up cumulative manufacturing capacities of around 39,600 MW.

Incorporation and Mandate

The Government of India formed SECI in the year 2011 as a not-for-profit company (Sec. 25 of Companies Act, 1956) for the implementation of the National Solar Mission and converted to a commercial company in 2015 (Sec. 3 of Companies Act, 2013) with mandate of developing the complete RE Sector. Since then, the company supplies RE on a pan-India basis and is the primary aggregator for many Government schemes for development of various RE segments. The company also undertakes its own projects and offers consultancy in the field of Renewable Energy.

Our Driving Force Towards National Goals

Over the years, the Renewable Energy sector in India has seen rapid growth due to global commitments, provisions of government policies and technological advancements. The Panchamrit goals announced at COP26 have laid the foundation for the country for expansion and adoption of RE on a large scale. As a step towards achieving these goals, the Government has notified four Renewable Energy Implementing Agencies (REIAs) which have been assigned targets as per the Bidding Trajectory. These agencies have to bring out bids for solar, wind, hybrid, RTC, etc. as per their assessment of the RE market or as per directions of the Government. SECI being the foremost REIA is working continuously towards fulfilling these targets and has shown exemplary performance.

#

Name

Park Capacity (MW)

Project Capacity Commissioned (MW)

1

Andhra Pradesh Solar Power Corporation Private Limited (A 50-50 Joint Venture of SECI and Andhra Pradesh Govt.)

4000

3300

2

Karnataka Solar Power Development Corporation Limited(A 50-50 Joint Venture of SECI and Karnataka Govt.)

2050

2050

3

Lucknow Solar Power Development Corporation Limited(A 50-50 Joint Venture of SECI and Uttar Pradesh Govt.)

475

365

4

Renewable Power Corporation of Kerala Limited (A 50-50 Joint Venture of SECI and Kerala Govt.)

205

100

5

Rewa Ultra Mega Solar Limited (A 50-50 Joint Venture of SECI and Madhya Pradesh Govt.)

3700

2363

6

Himachal Renewables Limited (A 50-50 Joint Venture of SECI and Himachal Pradesh Govt.)

-

-

Total

10430

8178

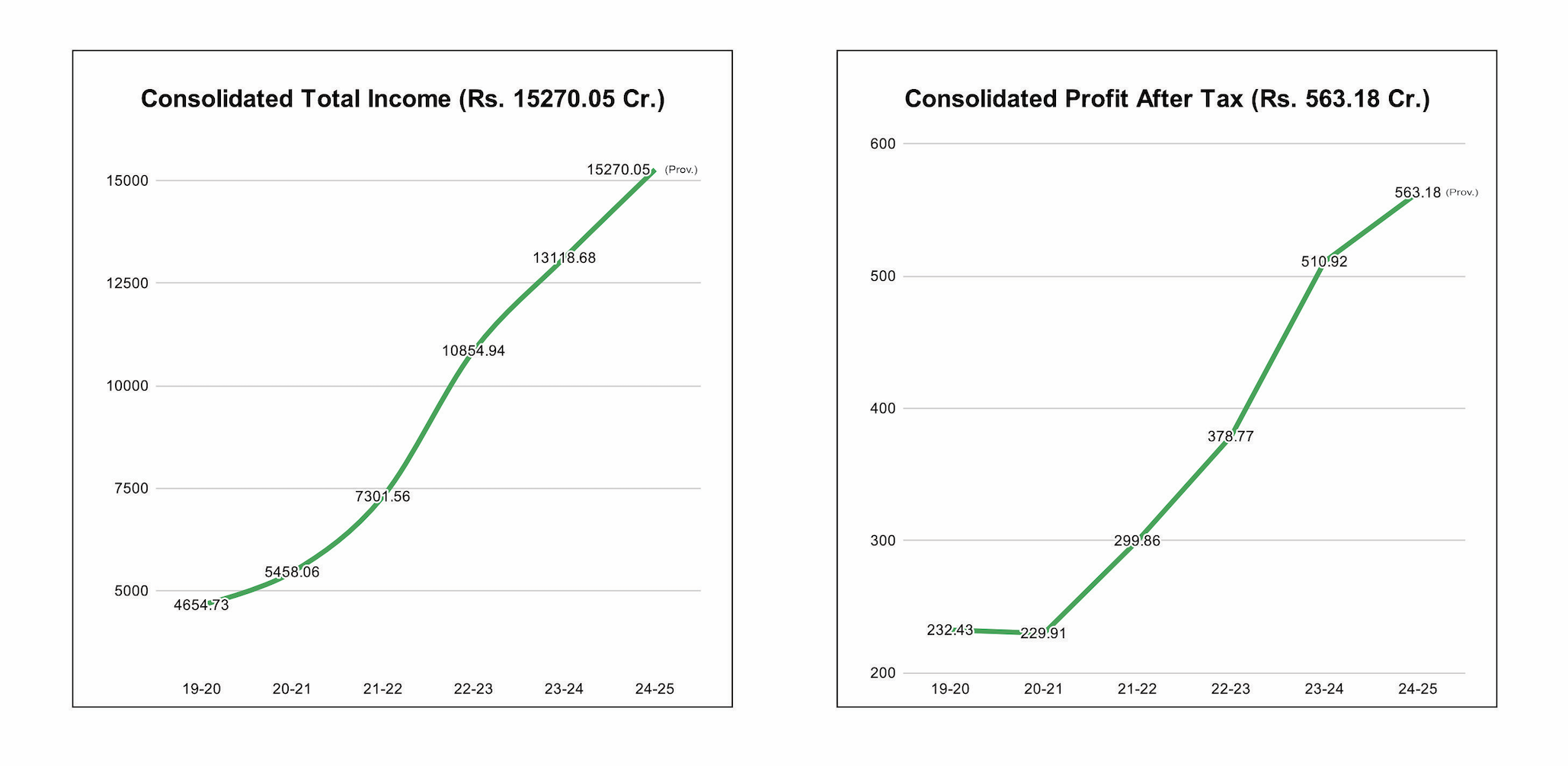

Financial Performance (Consolidated)